As we age, our cognitive abilities naturally decline, and with it, our ability to handle complex financial tasks. This decline has made older adults more vulnerable to financial scams, from email phishing attempts to phone calls designed to swindle their life savings. A new study from Binghamton University provides insight into how age-related changes in the brain affect financial management skills and offers suggestions for maintaining financial sharpness later in life.

The research, conducted by Associate Professor Ian M. McDonough, along with co-author Macarena Suárez-Pellicioni of the University of Alabama, was published in Archives of Gerontology and Geriatrics. The paper, titled “Separating Neurocognitive Mechanisms of Maintenance and Compensation to Support Financial Ability in Middle-Aged and Older Adults: The Role of Language and the Inferior Frontal Gyrus,” investigates the neurocognitive factors that influence financial abilities in adults aged 50 to 74. Using MRI scans and simple financial tasks, the researchers observed how brain structure and function relate to everyday financial decision-making.

The Cognitive Demands of Financial Management

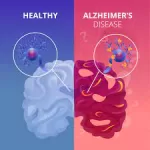

Managing finances is no simple task. It involves multiple cognitive domains, including memory, executive function, and numerical ability. As we age, subtle declines in these areas can make financial management more challenging. Previous research primarily focused on the parietal cortex, which plays a role in attention and simulating potential outcomes, but McDonough’s study sheds light on other brain regions, particularly those linked to math processing.

Financial tasks rely on two distinct areas of the brain. The first, the inferior frontal gyrus, stores math facts we memorize over time. For example, when asked “What is 3 plus 3?”, this part of the brain quickly retrieves the answer—6—without the need for calculation. The middle frontal gyrus, however, comes into play when calculations are required, such as when figuring out the sum of more complex numbers. This area demands more brainpower, increasing the chances of making errors.

As we age, the brain’s prefrontal cortex, responsible for executive function, begins to shrink, leading to greater reliance on compensatory brain regions. For older adults, this compensation can result in mistakes in financial tasks, which, McDonough notes, could increase vulnerability to scams and fraud.

Preserving Financial Independence

Despite these challenges, McDonough’s research suggests that financial competence in older adults depends more on language processing than on pure mathematical ability. People who maintained strong language skills performed better on financial tasks, likely due to better connectivity between different areas of the brain. Furthermore, individuals with higher household incomes and greater financial literacy were more protected against cognitive declines related to financial management.

Financial literacy—especially when fostered early in life—appears to be a key factor in preserving sharp decision-making skills as we age. McDonough suggests that regularly practicing mathematical skills learned in school, particularly by maintaining verbal representations of math, can help older adults continue managing their finances effectively throughout life.

Protecting Against Financial Exploitation

However, despite these protective factors, the aging brain remains susceptible to financial abuse and scams. McDonough emphasizes the importance of caregivers and older adults recognizing signs of cognitive decline that could lead to financial vulnerability. Legal safeguards, such as appointing power of attorney for automatic payment systems, can protect older adults while still allowing them to retain control over their financial decisions.

“Managing finances is crucial to maintaining independence later in life,” McDonough said. “We need to have interventions that can strengthen the brain and help keep people healthy when managing their finances.”

The study highlights the critical need for both financial education and cognitive health interventions to support older adults in their financial decision-making, ultimately preserving their independence and safeguarding them from exploitation.

For more information, refer to the study: Macarena Suárez-Pellicioni et al., “Separating Neurocognitive Mechanisms of Maintenance and Compensation to Support Financial Ability in Middle-Aged and Older Adults: The Role of Language and the Inferior Frontal Gyrus,” Archives of Gerontology and Geriatrics (2024). DOI: 10.1016/j.archger.2024.105705.