New Delhi, December 22, 2024: In a significant move aimed at easing the financial burden on healthcare, Finance Minister Nirmala Sitharaman announced that gene therapy will now be exempt from the Goods and Services Tax (GST). The announcement was made following the outcome of the 55th GST Council meeting, which was held earlier today.

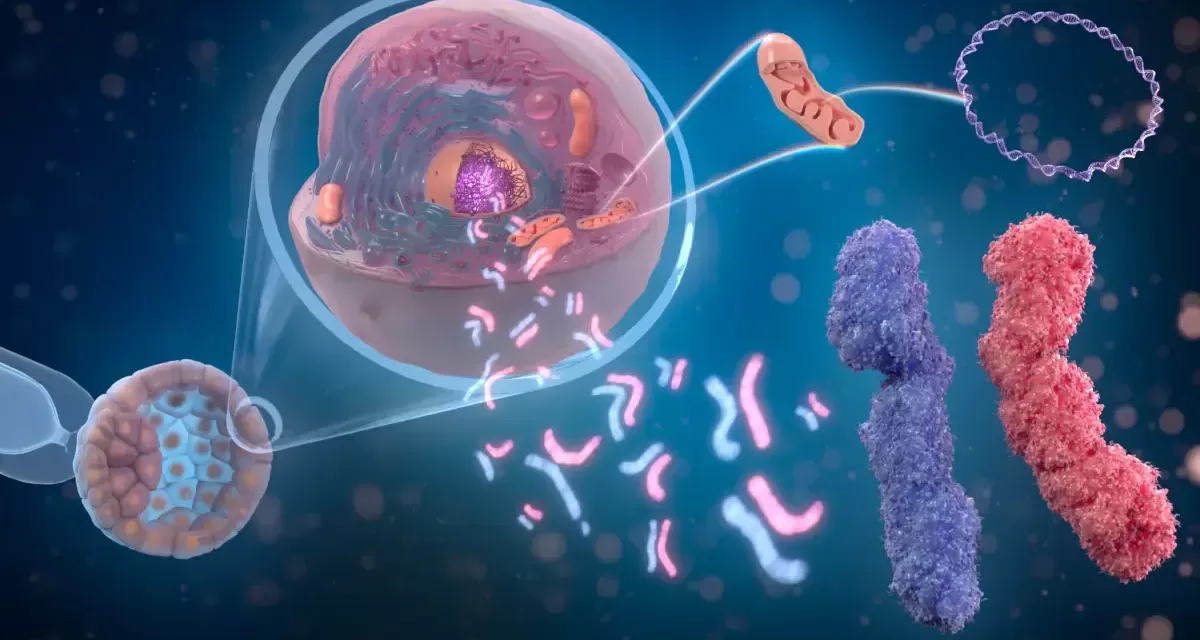

The exemption comes as part of the government’s ongoing efforts to make advanced treatments more accessible and affordable to the public. Gene therapy, a groundbreaking treatment method that involves altering the genetic material within a person’s cells to treat or prevent disease, has shown immense promise in addressing rare and life-threatening conditions. However, the high cost of gene therapy has often been a barrier for many patients.

In her briefing after the meeting, Sitharaman explained that the decision was made to ensure that life-saving treatments reach patients without the additional financial burden of GST, which had previously been levied on these therapies. The move is expected to significantly reduce the cost of treatment, making it more affordable for those in need.

“The decision to exempt gene therapy from GST is a step towards ensuring that cutting-edge healthcare technologies are accessible to all, especially those suffering from rare genetic disorders,” Sitharaman said.

The Finance Minister also emphasized that the decision was in line with the government’s commitment to improving the accessibility and affordability of healthcare in the country. This move is seen as a critical intervention in the healthcare sector, which continues to face challenges of rising costs and limited access to advanced treatments.

The GST Council’s decision comes after discussions with healthcare experts, industry stakeholders, and patient advocacy groups, all of whom have long called for the reduction of the financial burden associated with gene therapies.

This exemption is expected to have a positive impact on the Indian healthcare system, particularly for patients with rare genetic disorders, who will now be able to access life-changing treatments without the additional GST charges that previously made these therapies prohibitively expensive.

The GST Council’s decision has been widely praised by medical professionals, patients, and advocacy groups, who view it as a milestone in India’s efforts to modernize its healthcare sector and provide better treatment options to its citizens.

Background on Gene Therapy and its Costs

Gene therapy is a revolutionary medical field that aims to treat diseases at their genetic root by inserting, altering, or removing genes within an individual’s cells. These therapies are often used to treat rare and inherited conditions that were previously considered incurable. While gene therapy holds immense potential, the cost of these treatments can be prohibitively high, with prices often running into millions of rupees. The exemption from GST is expected to reduce some of the financial burden associated with these treatments.

The GST Council’s latest decision represents a major milestone for both the healthcare and taxation sectors in India, with experts hoping it will lead to similar measures for other life-saving treatments in the future.